Types of Forex Trade Execution: Market, Instant, and Request Execution Explained Simply

Introduction

Understanding the types of Forex trade execution is essential for any trader aiming for consistent results. Execution methods directly affect how quickly your orders are filled, at what price, and whether your strategy can perform effectively in real-time market conditions. Each trading style—whether scalping, swing trading, or news-based entries—relies on the right execution model to function properly.

In this article, we’ll break down the three most common types of order execution in Forex: Market Execution, Instant Execution, and Request Execution, explaining how each works and when to use them.

At Fastpip, we go beyond just providing copy trading and professional trading signals—we also help our users understand the mechanics behind every trade. Knowing how your broker executes orders can be just as important as the signal itself.

What Is Trade Execution?

Before diving into the types of trade execution in forex, it’s important to understand what execution actually means. When you place a buy or sell order on a trading platform, that order must be processed and executed by the broker. Trade execution refers to the process of submitting, processing, and completing your order in the market, meaning the moment your trade is filled at a specific price.

In the forex market, trades are typically carried out as Contracts for Difference (CFDs). This means you don’t own the physical currency or asset; you’re simply speculating on its price movements. That’s why the speed and method of execution matter significantly—they can influence the final result of your trade, whether it ends in profit or loss.

👉 If you’re unfamiliar with CFDs or other types of financial markets, we recommend reading our full guide: “Understanding Financial Markets: Spot, Futures, Forwards, Options, and CFDs.”

Market Execution

Market Execution is one of the most common methods of order execution in the forex market. In this model, when a trader places a buy or sell order, the broker executes it at the best available market price at that moment, even if that price slightly differs from what was displayed on the platform.

In this type of execution, the trader does not specify an exact entry price. They only decide to enter a trade, and the order is executed quickly at the best price available in the market at that time.

✅ Advantages of Market Execution:

-

Fast execution with minimal delay

-

No requotes—ideal for volatile markets

-

Commonly used in ECN and STP accounts with direct market access

-

Suitable for scalping, short-term strategies, and traders who prioritize speed

❌ Disadvantages of Market Execution:

-

Lack of price certainty: The executed price may differ from the one visible on the screen at the time of the order

-

Slippage: In highly volatile conditions, the difference between the requested price and the executed price can be significant

-

Extra commissions: Some ECN accounts may charge additional commission fees

MetaTrader trading Platform, Market Execution

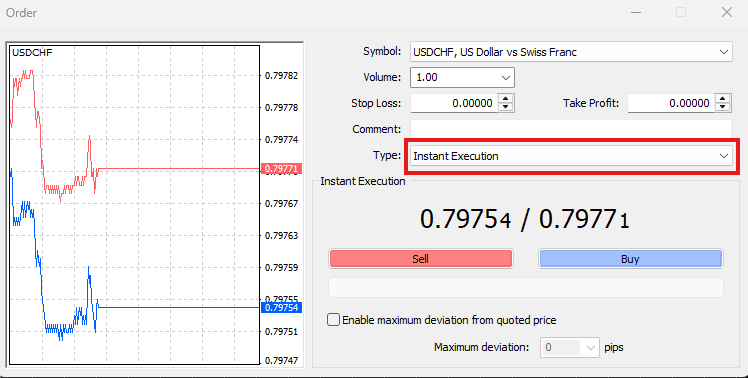

Instant Execution

Instant Execution is a type of order execution where the trader sets a specific price for buying or selling. If the broker can match that price, the order is executed immediately. However, if the market price changes, the system may display a requote, giving the trader the option to accept or reject the new price.

In this model, price control is in the hands of the trader at the moment of entry. On the downside, execution may be delayed or even rejected, especially during periods of high market volatility.

✅ Advantages of Instant Execution:

-

Orders are executed exactly at the trader’s specified price

-

Suitable for strategies where precise entry is important

-

Works well in low-volatility or stable markets

-

No slippage, since execution only happens at the requested price

❌ Disadvantages of Instant Execution:

-

Requotes may occur: If the price changes, the order won’t be filled until the trader confirms the new price

-

Execution delays: Potential missed opportunities during fast market moves

-

In highly volatile conditions, the risk of order rejection increases

MetaTrader trading Platform, Instant Execution

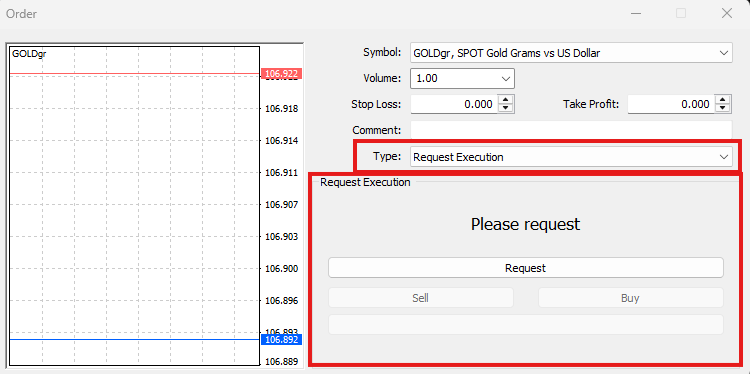

Request Execution

Request Execution is a type of trade execution where the trader first sends a buy or sell request to the broker. The broker then responds with a specific price, and the trader can choose whether or not to proceed with the trade at that quoted price.

This model offers a high degree of control over pricing, but usually comes with slower execution and is more common among market maker brokers.

✅ Advantages of Request Execution:

-

Full control over execution price—the trade only happens if the trader accepts the quoted price

-

Ideal for low-volatility markets and strategies that require precise entries

-

Allows time to review conditions before confirming the trade

-

No slippage, as execution only occurs after confirmation

❌ Disadvantages of Request Execution:

-

Slower execution—the time between request and confirmation can lead to missed opportunities

-

Less effective in high-volatility conditions due to delayed decisions

-

The quoted price may sometimes be less attractive or arrive with a delay

MetaTrader trading Platform, Instant Execution

This model is typically used on platforms where order execution requires manual confirmation, and it is more commonly found among market maker brokers. Request Execution is suitable for traders who prioritize precise control over price, though it generally offers slower execution compared to other methods.

Comparison Table: Types of Forex Trade Execution

| Feature | Market Execution | Instant Execution | Request Execution |

|---|---|---|---|

| Price Type | Best available market price | Predefined price | Price quoted by broker |

| Execution Speed | Very high | Medium | Low |

| Requote Possibility | No | Yes | No |

| Slippage Risk | Yes | Low | None (executed only after approval) |

| Price Control | Low | High | High |

| Best for Market Type | Volatile, fast-moving markets | Calm, low-volatility markets | Low-volatility or precision-focused |

| Commonly Used In | ECN, STP accounts | Market maker accounts | Market maker accounts |

Conclusion: Which Trade Execution Type Is Right for You?

Understanding the different types of forex trade execution is essential for every trader, as choosing the right execution method can directly affect your trade’s speed, accuracy, and overall outcome.

If your strategy relies on speed and fast market entry—such as scalping or news trading—then Market Execution may be the best choice for you. On the other hand, if having precise control over entry price is more important, Instant Execution or Request Execution could be more suitable, especially in calm or less volatile market conditions.

Ultimately, the choice of execution type should align with your trading strategy, style, and market conditions. It’s highly recommended to carefully review your broker’s execution model before trading with a live account, and whenever possible, test it thoroughly on a demo account first.

Sources

MetaQuotes Ltd. – Technical documentation on order execution methods in MetaTrader 4 and MetaTrader 5 platforms.

Official website: www.metaquotes.net