Best Forex Strategies for Beginners

Learn simple and effective Forex strategies designed for beginners. Start trading with confidence and build a strong foundation for long-term success.

Introduction

Starting out in Forex trading can feel both exciting and overwhelming. With thousands of currency pairs, constant price movements, and endless market analysis, it’s easy for beginners to get lost. The truth is, success in Forex doesn’t come from luck — it comes from having a clear and consistent strategy.

A solid trading strategy acts like a roadmap: it helps you make decisions with confidence, avoid emotional mistakes, and build discipline. For beginners, choosing the right strategy is even more important, since it sets the foundation for future growth.

In this article, we’ll explore the most popular Forex strategies for beginners — from simple price action setups to moving average crossovers and breakout trades. By the end, you’ll know which methods are best to start with and how to use them to trade smarter.

👉 Want to save time and trade like professionals? Check out our Fastpip Forex signals for ready-to-use setups tailored to all levels of traders.

Why Having a Trading Strategy and Journal Matters

Many beginners jump into Forex trading without a clear plan, relying on luck or random decisions. This often leads to frustration and losses. A well-defined trading strategy is essential because it:

- Guides your decision-making process.

- Reduces emotional trading.

- Helps you stay consistent over time.

But having a strategy is not enough. To grow as a trader, you also need to keep a trading journal. A journal records every trade you make, including your reasoning, results, and emotions. Over time, this becomes a powerful tool for learning from mistakes and improving performance.

👉 Want to learn how to build a professional trading strategy step by step? Read our article: How to Build a Trading Strategy

👉 Curious about journaling and its benefits? Check out: Trading Journal Writing – Step-by-Step Guide

Popular Forex Strategies for Beginners

When starting out, most beginner traders feel overwhelmed by the number of trading methods available. The truth is, you don’t need to learn every complex system to become successful. What you need is a few simple and proven strategies that can guide your trading decisions.

Here are some of the most popular Forex strategies for beginners:

- Price Action Strategy

- Moving Average Crossover Strategy

- Breakout Strategy

- Scalping Strategy

- Elliot Wae Strategy

In the following sections, we will explain each strategy in detail, outlining how it works, its pros and cons, and which type of trader it suits best.

Price Action Strategy

What it is:

Price action trading is one of the simplest yet most powerful ways to analyze the market. Instead of relying on multiple technical indicators, traders study raw price movements on the chart. By observing candlestick formations, support and resistance levels, and market structure, they try to predict where the price is likely to move next.

Why it’s popular among beginners:

This strategy is highly popular because it gives traders a direct understanding of how the market behaves. Beginners find it easier to follow since it avoids the complexity of advanced indicators and focuses on price itself — the most reliable source of information. Moreover, it can be applied to any currency pair and across different timeframes, from short-term intraday trading to long-term swing trading.

Different styles of price action trading include:

- Support and Resistance Trading: Identifying key levels where price historically reverses or consolidates.

- Candlestick Patterns: Using setups like pin bars, engulfing candles, and doji to spot entry and exit points.

- Trendline Trading: Drawing trendlines to follow market direction and spot breakouts.

- Chart Patterns: Recognizing larger formations such as head and shoulders, double tops/bottoms, or triangles.

- Break and Retest: Entering trades when price breaks a level and then retests it as confirmation.

Each of these styles can be combined or used separately, depending on a trader’s personality and risk tolerance.

👉 Want to master this strategy step by step? Read our full article: Price Action Trading Strategy Explained

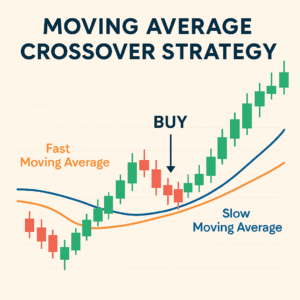

Moving Average Crossover Strategy

What it is:

The moving average crossover is one of the easiest and most beginner-friendly Forex strategies. It uses two moving averages: one short-term (fast) and one long-term (slow). When the short-term moving average crosses above the long-term moving average, it signals a potential buy opportunity. Conversely, when the short-term average crosses below the long-term average, it signals a sell.

Why it’s popular among beginners:

This strategy is very easy to understand and helps traders visually identify the market trend. It takes away much of the guesswork and provides clear entry and exit signals. Since it’s widely used, it also works well in trending markets where many traders react to the same signals.

Different styles of moving average trading include:

- Simple Moving Average (SMA) Crossover: The most basic form, using two SMAs with different periods.

- Exponential Moving Average (EMA) Crossover: More responsive to price changes, giving faster signals.

- Triple Moving Average System: Using three moving averages to confirm stronger trends and filter false signals.

- Moving Average with Support/Resistance: Combining MA crossovers with price levels to improve accuracy.

- Dynamic Support/Resistance: Using a single long-period moving average (like the 200 EMA) as a dynamic support or resistance line.

This versatility makes moving averages a powerful tool, not just for beginners but also for experienced traders who combine them with other strategies.

👉 Want to explore this method in detail? Read our guide: Moving Average Trading Strategies Explained

Breakout Strategy

What it is:

A breakout strategy focuses on trading when the price breaks through important support or resistance levels. These levels often act like “barriers” where price previously reversed or paused. When the market breaks past such a level, it often signals strong momentum, creating opportunities for big moves.

Why it’s popular among beginners:

Breakouts are easy to spot and often occur during high-volatility periods, such as after major news events. For beginners, this strategy provides clear entry signals and the chance to catch large price swings. Unlike strategies that require constant monitoring of indicators, breakout setups are straightforward and visually obvious on the chart.

Different styles of breakout trading include:

- Support/Resistance Breakouts: Entering when price breaks above resistance or below support.

- Trendline Breakouts: Using trendlines as dynamic barriers and trading the breakout when price crosses.

- Chart Pattern Breakouts: Trading breakouts from classic patterns such as triangles, flags, or head and shoulders.

- News Breakouts: Entering trades right after economic news releases when volatility spikes.

- Range Breakouts: Trading when price escapes from a sideways market into a trending phase.

Each type of breakout carries risks, especially false breakouts where the market quickly reverses after breaking a level. This is why many traders wait for confirmation, such as a retest of the broken level, before entering.

👉 Want to learn how to master breakouts? Check our article: Forex Breakout Trading Strategy Explained

Scalping Strategy

What it is:

Scalping is a trading style where traders open and close positions within seconds or minutes, aiming to capture very small price movements. Instead of holding trades for hours or days, scalpers make dozens or even hundreds of trades in a single session. The goal is to accumulate small but frequent profits that add up over time.

Why it’s popular among beginners:

Many new traders find scalping attractive because it offers quick results and multiple opportunities each day. The fast pace makes trading exciting and gives a sense of control over the outcome. However, scalping requires sharp focus, fast execution, and a reliable trading platform with low spreads.

Different styles of scalping include:

- One-Minute Scalping: Entering trades on ultra-short timeframes like the 1-minute chart.

- News Scalping: Trading the rapid price swings that happen right after economic announcements.

- Range Scalping: Exploiting small price movements in sideways markets.

- Trend Scalping: Following short-term momentum using fast indicators such as EMA or RSI.

- High-Frequency Scalping: Using automated trading systems (robots/EAs) to execute multiple trades per second.

Important note for beginners:

While scalping looks appealing, it’s not recommended as a starting point. The speed and intensity can overwhelm new traders, and transaction costs (spreads, commissions) can quickly eat into profits. For long-term success, it’s better to first master simpler strategies like price action or moving averages.

👉 Want to know more? Read our guide: Forex Scalping Strategies Explained

Elliott Wave Strategy

What it is:

The Elliott Wave strategy is based on the idea that markets move in repetitive cycles driven by investor psychology. According to Ralph Nelson Elliott’s theory, price moves in a series of five “impulse” waves followed by three “corrective” waves. By identifying these patterns, traders aim to forecast future price movements.

Why it’s popular among beginners:

Even though Elliott Wave analysis can seem complex at first, many beginners are drawn to it because it provides a structured way to view market trends. Instead of random price swings, the market is seen as an organized pattern of waves, making it easier to spot potential entry and exit points once you understand the basics.

Different styles of Elliott Wave trading include:

- Impulse Wave Trading: Focusing on the five-wave trend movement to trade in the direction of the trend.

- Corrective Wave Trading: Identifying A-B-C patterns to catch reversals or pullbacks.

- Wave Extensions: Spotting extended moves within impulse waves for stronger trend opportunities.

- Combination with Fibonacci: Using Fibonacci retracements and extensions to confirm Elliott Wave counts and entry levels.

- Multi-Timeframe Wave Analysis: Applying Elliott Wave principles across different timeframes for stronger confirmation.

Although Elliott Wave requires practice to master, once understood, it becomes a powerful tool to anticipate market direction with more accuracy.

👉 Want to explore Elliott Wave in detail? Read our article: Elliott Wave Trading: A Complete Practical Guide

Comparison Table

| Strategy | Why It’s Popular | Pros | Cons | Best For |

|---|---|---|---|---|

| Price Action | Simple and flexible, focuses on raw price moves | Easy to learn basics, no need for indicators, works on any pair | Requires practice to spot patterns accurately | All traders (especially beginners) |

| Moving Average Crossover | Clear visual signals, trend-following method | Easy to understand, widely used, identifies trend direction | Lagging signals, weak in ranging markets | Beginner traders |

| Breakout | Clear entry points during high volatility | Can capture large moves, effective after news events | False breakouts common, requires confirmation | Swing and news traders |

| Elliott Wave | Structured way to view market psychology | Helps forecast long-term moves, works with Fibonacci tools | Complex for beginners, requires practice | Intermediate traders |

| Scalping | Multiple trades, fast results | Many opportunities daily, quick profits | Stressful, high costs, not beginner-friendly | Advanced traders |

Key Tips for Choosing the Right Strategy

Choosing a Forex strategy is not just about picking the most profitable method. It’s about finding an approach that matches your personality, goals, and risk tolerance. Here are some essential tips to help you decide:

- Start Simple: Begin with easy-to-understand strategies like price action or moving averages before trying advanced methods.

- Match Your Lifestyle: If you have limited time, avoid scalping. If you enjoy fast-paced trading, short-term strategies may suit you.

- Practice First: Test any strategy on a demo account before risking real money. This builds confidence without financial pressure.

- Focus on Risk Management: Even the best strategy will fail without proper stop-loss placement and position sizing.

- Keep a Trading Journal: Record every trade you make. Reviewing your journal will help you identify what works and what doesn’t.

- Don’t Switch Too Often: Stick with one strategy long enough to evaluate its effectiveness. Constantly changing methods leads to inconsistency.

By following these tips, beginners can build a strong foundation and avoid many of the common mistakes that cause traders to give up too early.

Conclusion

For beginner traders, success in Forex comes down to simplicity and consistency. You don’t need dozens of complicated tools to get started — just one or two proven strategies that fit your personality and schedule.

Price action and moving average crossovers are often the best starting points because they are easy to understand and help you build a strong foundation. As you gain experience, you can experiment with more advanced approaches like breakout trading or Elliott Wave analysis. Scalping may look exciting, but it’s better reserved for advanced traders with the focus and speed to handle it.

No matter which strategy you choose, remember that the real key to long-term success is risk management and discipline. Use stop-loss orders, manage your position sizes, and keep a detailed trading journal to track your progress.

At Fastpip, our mission is to make your journey smoother. Whether you’re just starting or looking to refine your strategy, our Forex signals and educational resources are here to help you trade with confidence.

References

-

Investopedia – Top Strategies for Trading in a 24/7 Market

-

Babypips – Top Forex Trading Strategies

- Fastpip – How to Build a Trading Strategy: Step-by-Step Guide

Take the Next Step with Fastpip

Learning about different Forex strategies is just the beginning. The real challenge is applying them consistently and managing risk. At Fastpip, we help you bridge the gap between theory and practice.

With our professional Forex signals, you get ready-to-use trade setups based on proven strategies like price action, moving averages, breakouts, and more. You can also take advantage of our copy trading services, where you follow experienced traders in real time — perfect for beginners who want to learn while earning.

👉 Start your journey today with Fastpip Forex Signals and trade smarter, not harder.

Smart Signals Smart trading