FOMC Hawks and Doves: A Comprehensive Guide

Understanding the balance between hawks and doves in the Federal Reserve is key to interpreting interest rate decisions and monetary policy direction. This guide explains their current stance and why it matters for traders and investors.

Introduction

The Federal Reserve’s decisions drive the heartbeat of global financial markets. Every move in interest rates, every comment from policymakers, and every signal about future cuts or hikes can shift currencies, gold, and equities within minutes. For traders, understanding whether a Fed member is a hawk or a dove is not just academic—it’s a trading edge.

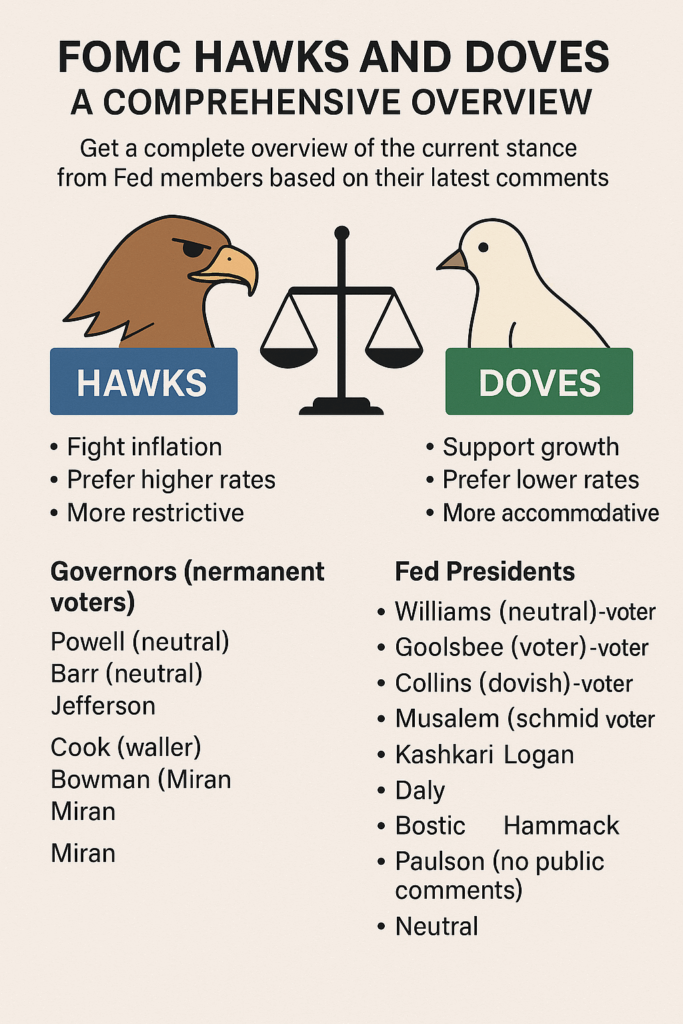

Hawks focus on controlling inflation, often favoring higher rates, while doves prioritize growth and employment, pushing for looser monetary policy. Knowing where each FOMC member stands helps traders anticipate policy shifts and adjust strategies accordingly.

At FastPip, we don’t just explain market dynamics—we help you trade them. Our Forex signals and copy trading services are built on professional analysis, risk management, and real-time execution. By combining insights like the hawk-dove balance at the Fed with actionable strategies, we give traders a smarter way to navigate volatility and capture consistent profits.

What Is the FOMC and Why Does It Matter?

The Federal Open Market Committee (FOMC) is the decision-making body of the U.S. Federal Reserve responsible for monetary policy. It meets regularly to set interest rates, guide liquidity, and signal the future direction of the economy. The committee is made up of the seven Federal Reserve governors (who are permanent voters) and five of the twelve regional Federal Reserve Bank presidents (who rotate voting rights).

The FOMC’s decisions directly influence the cost of borrowing, the strength of the U.S. dollar, global capital flows, and investor sentiment. A single statement or press conference can trigger volatility in currencies, gold, stocks, and bonds. This is why traders across the world follow FOMC meetings closely, often adjusting their positions based on whether the Fed appears more hawkish or dovish.

📊 FOMC Composition: Who Makes the Decisions?

| Category | Members | Voting Rights |

|---|---|---|

| Board of Governors | Jerome Powell (Chair), Michael Barr, Philip Jefferson, Lisa Cook, Christopher Waller, Michelle Bowman, Adriana Kugler | Permanent voters |

| Regional Fed Presidents | New York Fed President (John Williams) + 4 presidents from the remaining 11 Reserve Banks (rotating annually) | Rotating voters |

| Total Members | 19 (7 Governors + 12 Regional Presidents) | 12 vote at each meeting |

Who Are the Hawks in the FOMC?

In monetary policy, a hawk is a policymaker who prioritizes fighting inflation over stimulating growth. Hawks believe that keeping prices stable is essential for long-term economic health, even if it slows down employment or GDP growth in the short term.

Typical hawkish policies include:

-

Raising interest rates to reduce inflationary pressures.

-

Reducing the Fed’s balance sheet or limiting liquidity in the system.

-

Signaling caution about lowering rates too quickly.

For traders, hawkish members of the FOMC usually mean a stronger U.S. dollar, potential downward pressure on gold, and more volatility in equity markets.

Examples of hawkish Fed members in recent years include Thomas Barkin, Neel Kashkari (at times), and Michelle Bowman. Their statements often warn about the dangers of “cutting rates too soon” and emphasize the importance of returning inflation to the Fed’s 2% target.

Section 3 – Who Are the Doves in the FOMC?

In monetary policy, a dove is a policymaker who places greater emphasis on supporting growth and employment rather than aggressively fighting inflation. Doves are generally more comfortable with slightly higher inflation if it helps stimulate economic activity and job creation.

Typical dovish policies include:

-

Lowering interest rates to encourage borrowing, spending, and investment.

-

Supporting asset purchases or liquidity injections to stabilize markets.

-

Advocating for a gradual approach to tightening policy.

For traders, dovish members of the FOMC usually mean a weaker U.S. dollar, support for gold and equities, and easier financial conditions overall.

Examples of dovish Fed members include Lisa Cook, Austan Goolsbee, and Mary Daly, who often stress the importance of inclusive growth, avoiding unnecessary economic slowdowns, and protecting jobs.

🦅 Hawks vs 🕊 Doves in the FOMC

| Aspect | Hawks | Doves |

|---|---|---|

| Main Priority | Fighting inflation | Supporting growth & employment |

| Policy Stance | Tight / Restrictive | Loose / Supportive |

| Interest Rates | Prefer higher rates | Prefer lower rates |

| Liquidity | Reduce liquidity, shrink Fed balance sheet | Inject liquidity, asset purchases |

| Impact on USD | Strengthens the U.S. dollar | Weakens the U.S. dollar |

| Impact on Gold | Bearish for gold | Bullish for gold |

| Impact on Equities | Often bearish | Often bullish |

| Key Message | “We must control inflation, even if growth slows.” | “We must support jobs and growth, even if inflation rises.” |

Why Hawks vs Doves Matter for Traders

For traders, the hawk–dove balance inside the FOMC is more than political jargon—it directly impacts market opportunities. A shift toward hawkish policy often strengthens the U.S. dollar and pressures commodities like gold, while dovish signals tend to weaken the dollar and support risk assets such as equities.

Understanding this dynamic helps traders:

- Anticipate interest rate moves before they are officially announced.

- Position themselves in Forex pairs that are most sensitive to Fed policy (e.g., EUR/USD, USD/JPY, XAU/USD).

- Manage risk more effectively by preparing for volatility around FOMC meetings.

At FastPip, our Forex signals integrate these insights. By tracking whether the Fed leans hawkish or dovish, we help traders enter the market with greater confidence and turn central bank decisions into trading opportunities.

Neutral Members in the FOMC

Not all policymakers fit neatly into the hawk or dove categories. Some members are considered neutral, meaning their stance shifts depending on economic data. These members often balance inflation concerns with growth objectives, avoiding extreme positions.

Characteristics of neutral members:

- Open to both rate cuts or hikes depending on incoming data.

- Often signal “wait and see” in speeches.

- Provide balance between hawkish and dovish camps.

In 2025, several key FOMC voters are classified as neutral. This makes them especially important, because their swing votes can decide whether the committee tilts hawkish or dovish. According to recent comments, Powell, Barr, Jefferson, Williams, and Goolsbee are seen as neutral voters leaning toward two rate cuts in 2025.

For traders, monitoring these neutral voices is crucial since they often determine the decisive majority in policy shifts.

🦅 FOMC Members 2025 – Hawks, Doves, and Neutrals

| Category | Members (Key Names) | Voting Outlook 2025 |

|---|---|---|

| Hawks | Musalem, Schmid, Bostic, Hammack | Less than 2 rate cuts |

| Doves | Cook, Waller, Bowman, Miran, Collins, Daly | 3 or more rate cuts |

| Neutrals | Powell, Barr, Jefferson, Williams, Goolsbee, Kashkari, Logan, Barkin | Around 2 rate cuts |

| No Clear View | Paulson (no public comments yet) | – |

🗳️ Voting Breakdown (2025)

-

Neutral voters: 5

-

Dovish voters: 5

-

Hawkish voters: 2

📈 What This Balance Means for Markets

The current FOMC composition shows a delicate balance between doves and neutrals, with only a small hawkish minority. If neutral members tilt dovish, the Fed could move toward three or more cuts in 2025, weakening the U.S. dollar and supporting gold and equities.

On the other hand, if inflation data forces neutrals to lean hawkish, the outcome could be fewer than two cuts, boosting the dollar while adding pressure to commodities and risk assets.

For traders, this means volatility around each Fed speech and data release will remain high. Staying updated on Fed members’ comments is crucial for anticipating shifts in policy direction.

📝 Conclusion

The hawk–dove divide inside the FOMC is more than a political label—it shapes the future of U.S. monetary policy and drives volatility across global markets. In 2025, the balance is finely split between dovish and neutral members, with only a small hawkish camp. This makes the voices of neutral policymakers especially critical, as their stance could tip the scale toward either faster rate cuts or a more cautious approach.

For traders, keeping track of FOMC members’ comments is not optional—it’s essential. The direction of the U.S. dollar, gold, and equity markets often hinges on whether the Fed leans hawkish or dovish. By combining this knowledge with professional tools like FastPip Forex signals, traders can better anticipate market moves and turn central bank policy into profitable opportunities.

📚 References

- Federal Reserve – Monetary Policy Committee (FOMC)

Board of Governors of the Federal Reserve System – News & Speeches

Reuters – Federal Reserve Coverage

Investopedia – Hawks and Doves Definition