Silver Price Prediction: XAG/USD Extends Rally After Record September Performance

Silver Price Prediction for October 2025 shows that XAG/USD started the month with strong momentum after a record September rally.

Introduction

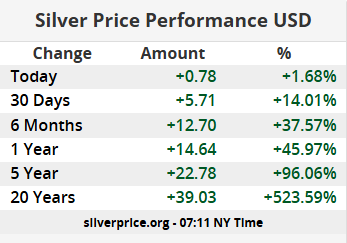

Silver entered October with strong momentum after delivering one of its best monthly performances in modern trading history. The metal surged by 19.7% in September, climbing from $39.65 at the start of the month to close at $46.63. This rally not only marked the strongest monthly advance since July 2020 but also positioned silver as one of the top-performing assets in 2025. Traders, investors, and institutions all turned their focus to XAG/USD, driven by a powerful mix of macroeconomic catalysts, technical strength, and geopolitical stress.

Unlike many assets that struggled with uncertainty in U.S. economic data, silver showed resilience. The move reflected both investor appetite for safe-haven assets and a broader shift in expectations surrounding the Federal Reserve’s monetary policy. By the first trading day of October, silver gained another 2% in the European session, pushing prices to $47.56 and extending its year-to-date growth to more than 60%.

This article provides a complete silver price prediction, combining technical signals, fundamental drivers, and market psychology. It explores why silver remains in focus, how geopolitical and macroeconomic risks support the rally, and what levels traders should watch as XAG/USD eyes the $48 mark.

Silver Price Prediction – September 2025 Performance

Silver’s September rally caught the attention of the entire commodity market. Prices advanced from $39.65 to $46.63, generating a monthly gain of 19.7%. This sharp increase echoed the explosive rally of July 2020 during the height of pandemic-driven uncertainty. The difference this time lies in the broader set of drivers: not only global risk sentiment but also central bank policy expectations and structural demand.

The final session of September carried a bearish tone after the U.S. Bureau of Labour Statistics reported stronger job openings at 7.22 million versus 7.2 million expected. Normally, stronger labor data supports the U.S. dollar and pressures dollar-denominated assets like silver. Yet, the metal maintained its broader upside trend. Market participants treated the dip as temporary noise in a larger bullish framework.

The rally also reflected a clear technical follow-through. Silver broke through multiple resistance zones during September, including the psychological $45 level, and confirmed a new higher-high structure on the daily chart. Traders used every corrective dip as a buying opportunity, confirming strong conviction behind the move.

Conclusion – What Comes Next for Silver?

Silver ended September with its strongest monthly performance since 2020 and carried this momentum into October. The rally reflects a powerful mix of macroeconomic stress, central bank expectations, and safe-haven demand. Technical signals point to stretched momentum, but market sentiment continues to support higher prices.

The $48 level remains the next key target for bulls, while $46 acts as the near-term floor. Traders should monitor upcoming U.S. economic data, Federal Reserve statements, and geopolitical headlines, as these factors will shape silver’s short-term path. In the medium term, as long as the U.S. dollar stays weak and investors seek protection against uncertainty, silver has the potential to extend its rally.

At FastPip, we believe informed trading decisions require both analysis and actionable signals. If you want to follow the latest silver trading signals (XAG/USD) and get real-time updates, visit our Silver Signals Section for daily strategies designed to help you trade with confidence.

Check Our

Check Our  Whether you’re a day trader or a long-term investor, FastPip gives you the tools to trade smarter, not harder.

Whether you’re a day trader or a long-term investor, FastPip gives you the tools to trade smarter, not harder.