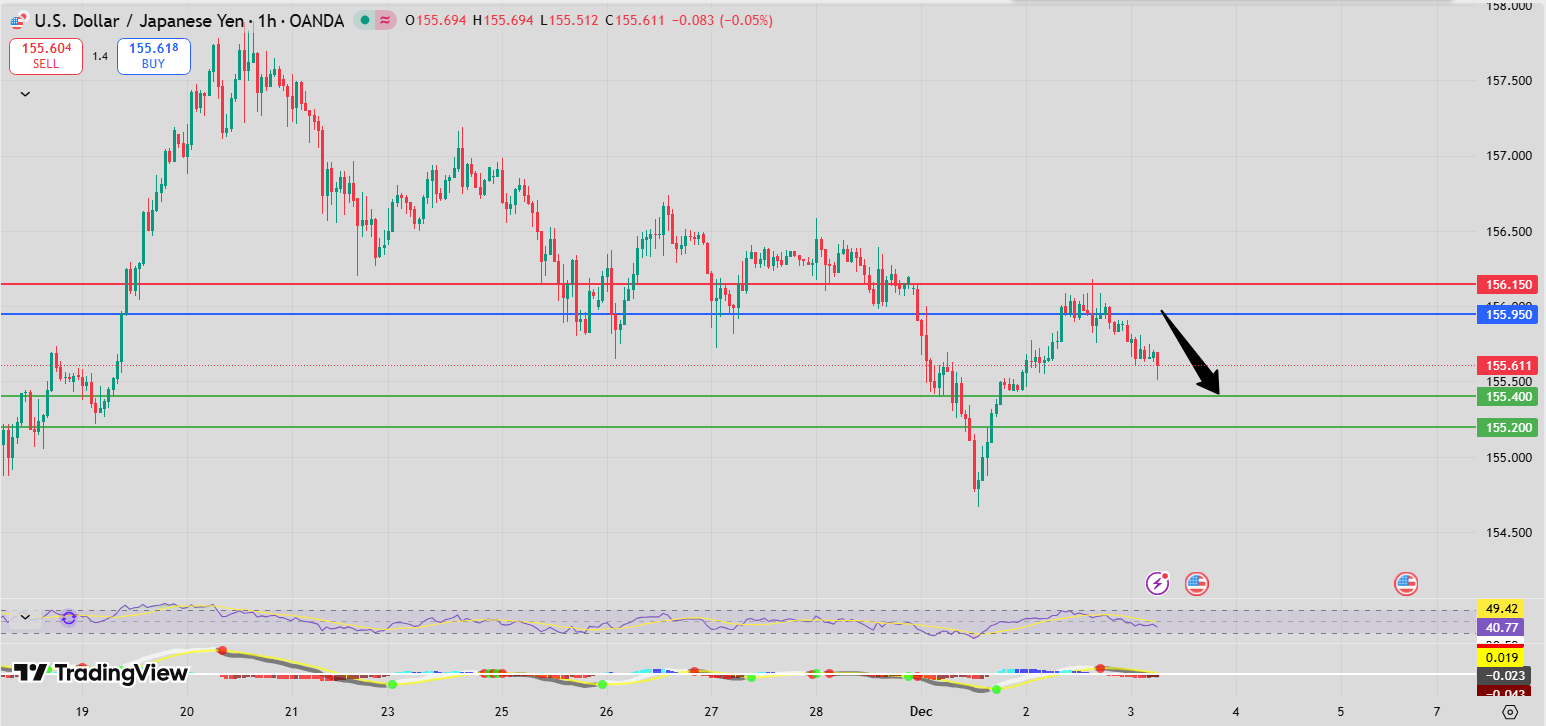

USD/JPY Intraday Signal: Consolidation With Bearish Potential Below 155.95

Analysis:

USD/JPY is currently consolidating, yet the intraday bias leans bearish as long as price remains below the pivot level at 155.95. Sellers are expected to target 155.40 and 155.20 in extension. The market shows hesitation near the pivot, but the short-term structure suggests emerging downside pressure.

The RSI trades below the 50-neutral line, signaling weakening momentum and increasing bearish sentiment. Within the current consolidation range, any rejection from the 155.95 resistance area could accelerate a move toward the downside targets.

Alternatively, a breakout above 155.95 would shift momentum upward, exposing 156.15 and 156.40 as the next resistance levels.

Trade Setup:

Enter: Short below 155.95

Stop-Loss (SL): 156.15

Target A: 155.40

Target B: 155.20