Best Time to Trade Forex: When to Enter the Market for Gold, Oil & Indices

Best time to trade Forex — it’s not just a technical detail, it’s a key to higher profits and lower risk. While the Forex market is open 24 hours a day, not all hours offer the same opportunity. Volatility, liquidity, and price behavior vary greatly depending on the trading session and the asset you’re dealing with — whether it’s gold, oil, or major US indices.

Knowing when to trade is just as important as knowing what to trade.

At FastPip, we help traders take advantage of the most profitable market hours through two key features:

- 📈 Free Trading Signals based on time-tested strategies during active sessions

- 🤖 Copy Trading System that automatically mirrors trades from top performers in optimal time windows

In this guide, we’ll break down the global trading sessions in UTC time, explore the best hours to trade different markets, and show you how to align your trading schedule with the most strategic times of day.

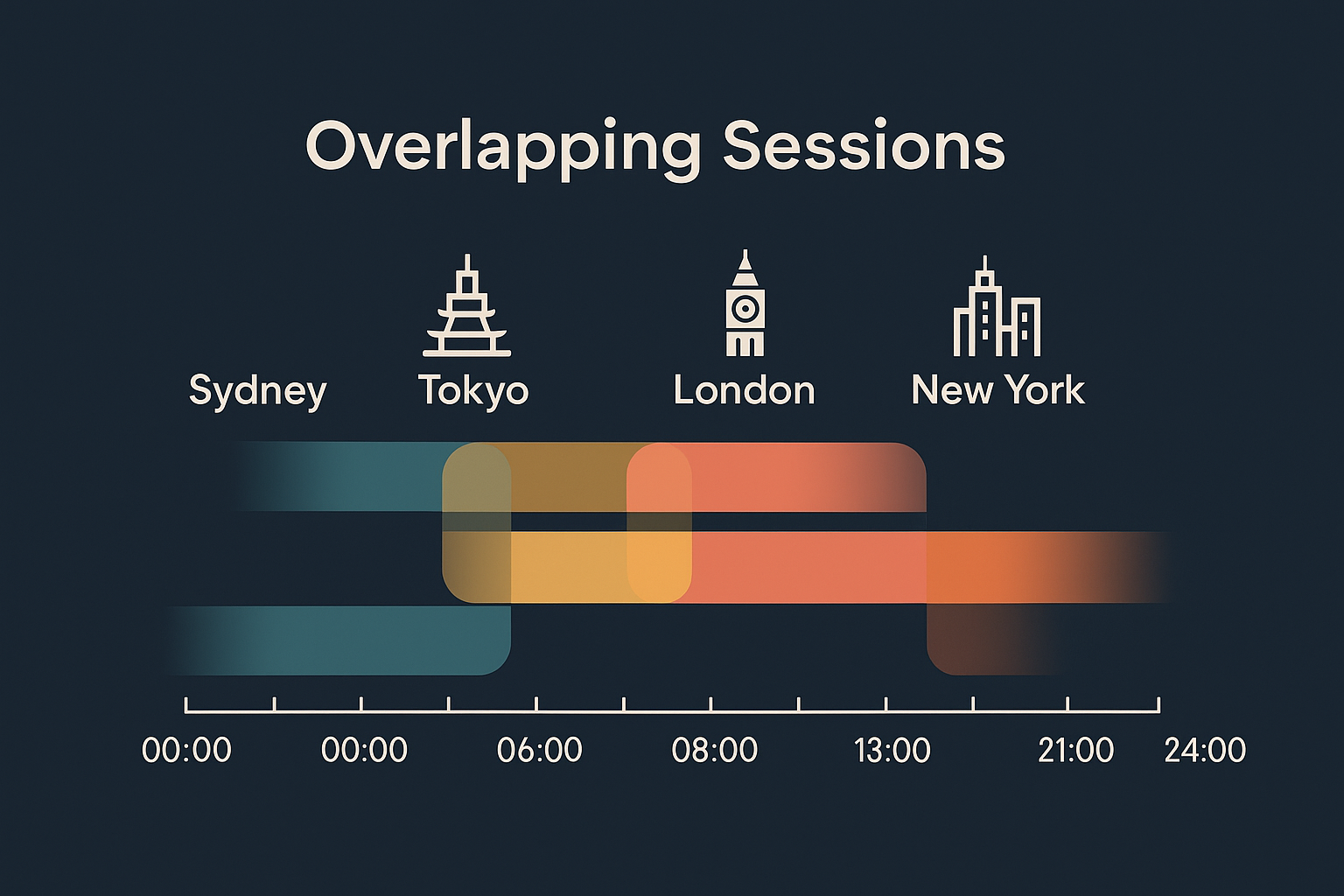

🌍 Best Time to Trade Forex Based on Global Sessions

The Forex market operates 24 hours a day, five days a week — but that doesn’t mean every hour offers the same potential. Liquidity, volatility, and price movement strength vary depending on the trading session.

Understanding the global sessions helps you pinpoint the best time to trade Forex, especially if you’re focusing on major currency pairs, gold, oil, or US indices.

Below is a breakdown of the most active and profitable trading windows (in UTC time):

🕐 Asian Session (00:00 – 09:00 UTC)

- Key Markets: Japan, Australia, New Zealand

- Active Pairs: USD/JPY, AUD/USD, NZD/JPY

- Market Traits: Stable price action, lower volatility, moderate liquidity

The Asian session is ideal for low-risk traders and pairs with AUD, NZD, or JPY. Trends are slower, but more predictable.

🕗 London Session (07:00 – 16:00 UTC)

- Key Markets: UK, Germany, Europe

- Popular Pairs: EUR/USD, GBP/USD, EUR/GBP

- Market Traits: High volume, strong volatility, trend acceleration

This session offers excellent opportunities for both trend and breakout traders, especially in Euro and Pound crosses.

🔁 London–New York Overlap (12:00 – 16:00 UTC)

- Why Important: This is the most liquid and volatile time of day

- Ideal For: Scalping, breakout strategies, high-impact news trades

- Popular Assets: EUR/USD, GBP/USD, Gold, US Indices (Dow, S&P 500), Oil

During this overlap, two of the biggest financial centers are active — creating the fastest price movements and best opportunities for short-term traders.

💡 Want to take advantage of these time windows without sitting at your screen all day?

Use FastPip’s Copy Trading system to automatically follow expert traders who trade during the most profitable hours — or get Free Signals sent to you at peak times.

When Forex and Other Markets Move the Most

| Market | Peak Activity (UTC) | Key Reason |

|---|---|---|

| Forex | 12:00 – 16:00 | London–New York overlap session |

| Gold (XAU/USD) | 13:00 – 17:00 | US news releases and NYSE open |

| Oil (WTI/Brent) | 13:00 – 18:00 | API/EIA inventory reports, macro triggers |

| US Indices | 13:30 – 16:30 | Wall Street open; institutional trades |

💡 Trading Strategy Tips Based on Forex Market Timing

Timing your strategy to match the behavior of each market can significantly improve your results. Here’s how to align your trading approach with the best time to trade Forex, gold, oil, and indices:

🔄 Forex

Focus on breakout and trend-following strategies during the London–New York overlap (12:00–16:00 UTC) — the most liquid and volatile window.

📘 Want consistent results? Start by learning how to build a Forex trading strategy.

🪙 Gold (XAU/USD)

Gold responds strongly to U.S. economic news, especially during the early New York session (13:00–17:00 UTC). Look for momentum-based setups around these times for short- to medium-term gains.

🛢 Oil (WTI & Brent)

Midweek volatility often increases due to inventory reports like the EIA data. Combine technical setups with geopolitical news to trade oil effectively — especially around Wednesdays.

📈 US Indices (e.g., Dow Jones, S&P 500)

Target the first few hours after the NYSE open (13:30–16:00 UTC) for fast price moves and volatility spikes. Ideal for scalping and momentum-based strategies.

⚠️ When to Avoid Trading Forex and Other Markets

Not every trading hour is worth your time — some periods can expose you to higher risk and lower reward due to poor market conditions. Here are the times when you should avoid trading Forex, gold, oil, or indices, regardless of your strategy:

🕘 21:00 – 00:00 UTC

This period sits between the U.S. close and Asian open — liquidity is low, spreads are wide, and price action is unreliable.

🎄 Major Global Holidays

Days like Christmas, New Year, and Easter bring extreme thin volume and erratic market behavior. Most professional traders avoid these days completely.

🚨 Just Before High-Impact News (Without Preparation)

Entering a trade minutes before economic news releases (like NFP, CPI, FOMC) without a solid plan can lead to massive slippage and unpredictable spikes.

🕓 Late Fridays (After 16:00 UTC)

Liquidity dries up as institutional traders close positions before the weekend. Gaps on Monday open are also common, especially in geopolitical or commodity-driven markets.

🕒 Tool to Track Forex Session Hours Live

Timing is everything in trading — and having a reliable tool to monitor Forex session hours and overlaps can help you plan smarter trades.

One of the best free tools available is:

🔗 Market24hClock.com — an interactive 24-hour visual clock that displays global market sessions in real time based on your local timezone. It’s especially helpful for identifying when London–New York overlaps, Asian session open, and major market transitions occur.

📊 Infographic: Best Time to Trade Forex and Related Markets

Need a quick reference?

Check out our visual infographic that summarizes the best trading windows for:

- Forex

- Gold

- Oil

- US Indices

✅ Save it, share it, or keep it open as you trade.

✅ Conclusion: Use Forex Trading Time Wisely

Knowing the best time to trade Forex isn’t just helpful — it’s a competitive advantage. By aligning your strategy with the most active market sessions, you gain:

- Better trade execution

- Tighter spreads

- Higher probability setups

- And improved overall performance

But timing is only one part of success. If you’re new to trading or simply too busy to monitor the markets all day, let experts trade for you.

👉 Check out our complete Forex Copy Trading Guide and follow top-performing traders automatically — especially during high-liquidity hours.

📌 Want to trade around news events with precision?

Don’t miss our article:

🔎 Step-by-Step News Trading Strategy — where we walk you through how to prepare for economic releases and time your entries like a pro.