How to Build a Trading Strategy That Actually Works: A Step-by-Step Guide

🧠 Introduction

How to build a trading strategy is the foundation for success in the Forex market — the largest and most dynamic financial market in the world. However, due to its high leverage and volatility, it’s also one of the riskiest. To survive and grow consistently, traders need a structured, repeatable approach that goes far beyond market predictions.

At FastPip, we not only guide you through creating your own strategy, but we also provide free trading signals based on proven strategies — the same ones we use in our copy trading system.

In this article, we’ll walk you step-by-step through how to build a trading strategy and show you how tools like copy trading can enhance your overall plan.

🧭 How to Build a Trading Strategy — and Why It’s Essential

A trading strategy is more than just a plan — it’s your personal roadmap for navigating the markets. It defines how you enter and exit trades, manage risk, and analyze market conditions. Most importantly, it removes emotional bias from your decision-making process and replaces it with structured logic and proven methods.

✅ Why Having a Clear Strategy Matters:

- Eliminates emotional and impulsive trading

- Allows you to track, review, and optimize performance

- Builds discipline and trading consistency

- Improves risk and capital management

- Makes it easier to detect and correct mistakes

Learning how to build a trading strategy gives you control, structure, and confidence — helping you transition from guesswork to growth in the Forex market.

🔧 Key Components to Create a Forex Trading Strategy for Consistent Profit

Designing a strong Forex trading strategy requires more than just chart patterns — it demands a full structure built for consistent profit. Below are the key elements every trader should consider when building a strategy that works in real market conditions:

🕒 Trading Time Based on Forex Market Sessions

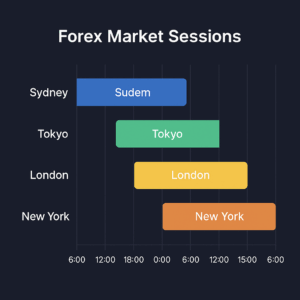

The Forex market runs 24/5, but liquidity and volatility vary across sessions.

Focus on the major ones:

- Asian Session (Tokyo): Low to moderate volatility

- European Session (London): High volume, strong trends

- U.S. Session (New York): Volatile, overlaps with London session

👉 Learn more: Best Time to Trade Forex, Gold, Oil & US Indices (UTC)

💱 Choosing the Right Currency Pairs

Not all pairs behave the same. Choose assets based on:

- Volatility: GBP/JPY is fast and wild, EUR/USD is steady

- Spreads and liquidity

- Sensitivity to news events

👉 Recommended reading: Best Currency Pairs for Forex Strategy

🎯 Entry and Exit Rules

Define clear rules for:

- When to enter: Use tools like EMA crossovers, RSI divergence, or breakout confirmation

- When to exit: Based on targets, reversal signals, or trailing stops

📏 Position Sizing

Use smart risk control — don’t risk more than 1–2% of your capital per trade. This helps maintain long-term stability and avoids blowing your account.

💰 Capital and Leverage Management

Leverage boosts both profits and risks. Ensure your strategy:

- Accounts for margin requirements

- Maintains healthy equity buffers during drawdowns

🎯 Take Profit (TP) Targeting

Set TP levels using:

- Technical levels (support/resistance)

- ATR (Average True Range)

- Risk-to-reward ratio (e.g., 1:2 or 1:3)

Also consider trailing stops to lock in more profit as trades move in your favor.

🛑 Stop Loss (SL) Protection

Never trade without a Stop Loss. Place it:

- Below/above key market structure

- Never emotionally — use logic and analysis

🚨 Emergency Exit Conditions

Sometimes, market conditions break your rules. Be prepared to exit immediately if:

- A high-impact news event is released

- Spreads suddenly widen

- Price breaks key support/resistance in unexpected ways

📊 Best Indicators for Strategy Creation

Don’t overload your chart. Use a balanced combination like:

- RSI + EMA

- MACD + Price Action

- Fibonacci retracements for confirmation

Stick to what you understand and test it thoroughly.

💡 Pro Tip: The best Forex trading strategies are simple, consistent, and built around your personality and goals.

🧩 Step-by-Step Guide to Building a Trading Strategy

Creating a solid trading strategy isn’t just about indicators — it’s about aligning your plan with your goals, personality, risk profile, and long-term consistency. Here’s a step-by-step guide on how to build a trading strategy that fits your style and delivers results.

-

🎯 Define Your Trading Goals

Start by asking:

Are you aiming for monthly income, long-term wealth building, or a side hustle?

Your goals determine:

- The timeframes you’ll trade

- The frequency of trades

- The type of strategy (aggressive, conservative, etc.)

-

🧠 Match a Trading Style to Your Personality

Every trading style comes with different demands. Choose what suits your:

- Patience level

- Time availability

- Emotional temperament

Popular styles include:

- Scalping: fast-paced, stressful

- Day trading: multiple trades per day

- Swing trading: hold for days

- Position trading: long-term outlook

-

📈 Set Entry and Exit Rules

Your Forex trading strategy must define:

- Exact entry signals (e.g., EMA crossover + RSI confirmation + breakout)

- Specific Take Profit (TP) levels

- How you’ll manage trades during trend shifts

Without these, you’re just guessing.

-

💰 Build a Money Management Plan

Risk control is what turns a good strategy into a sustainable one.

Key rules:

- Risk a fixed % per trade (usually 1–2%)

- Always use Stop Loss (SL) and Take Profit (TP)

- Never double down after a losing trade

📘 Want to learn more about Forex risk control?

👉 Read our full guide on Risk Management in Forex

-

🧪 Backtest Before You Go Live

Use tools like TradingView, MT4 Strategy Tester, or Myfxbook to test your strategy on historical data.

Look for:

- Win rate

- Drawdown

- Risk-to-reward ratio

- Consistency over time

-

🧾 Demo Trade to Build Confidence

Don’t rush into real money. Use a demo account to:

- Practice execution

- Refine rules

- Build emotional discipline without financial risk

-

✍️ Keep a Trading Journal

Record every trade to identify patterns and mistakes. Include:

- Entry/exit time and price

- Trade rationale

- Profit/loss result

- Emotional state before and after trade

This is key to continuous improvement.

-

🔧 Optimize Your Strategy

Review your trading journal weekly or monthly.

Adjust:

- Indicators

- Entry/exit conditions

- Risk model

- Position size

Test every change — never assume.

-

🧘♂️ Mindset Matters Most

Even the best strategy fails without the right mindset.

Success comes from:

- Emotional control

- Patience

- Trusting your system — especially during drawdowns

Stick to your rules, and consistency will follow.

📚 Examples of Popular Trading Strategies

As you learn how to build a trading strategy, it’s helpful to explore proven approaches that traders around the world use successfully. Here are some popular strategies you can study, adapt, or even combine with copy trading to match your goals:

🔓 1. Breakout Strategy

Focuses on trading price breakouts above resistance or below support levels — usually during high volatility sessions. Ideal for capturing early trend movements.

Key tools: Support & Resistance, Volume, Volatility indicators

📉 2. Mean Reversion Strategy

Assumes that price tends to revert to its average over time. Traders use it to sell when price is overextended and buy when it’s undervalued.

Key tools: Bollinger Bands, Moving Averages, RSI

📊 3. Price Action Strategy

No indicators — just raw price analysis using candlestick patterns, trendlines, and chart structures. Clean and favored by many professional traders.

Key tools: Candlesticks, Chart Patterns, Market Structure

📈 4. MACD + EMA Strategy

Combines trend-following (EMA) with momentum confirmation (MACD) to time entries during strong moves.

Key tools: MACD histogram, EMA (e.g., 20, 50, 200), Signal Line Crossovers

🕘 5. London Session Strategy

Targets volatility and liquidity during the overlap between London and Frankfurt markets. Often uses scalping or breakout techniques.

Best Time: 07:00–10:00 UTC

Pairs: GBP/USD, EUR/USD, GBP/JPY

🤝 6. Copy Trading + Personalized Strategy

Use copy trading to mirror expert trades while developing your own system on the side. This hybrid approach allows beginners to earn while they learn.

Recommended on: FastPip Copy Trading

✅ Final Thoughts

Learning how to build a trading strategy is not just about technical indicators — it’s about creating a framework that promotes discipline, consistency, and long-term success in the Forex market. By combining clear rules, structured planning, and strong risk management, you give yourself the best chance to grow sustainably.

Whether you’re a beginner or an experienced trader, building your own strategy puts you in control.

Start simple. Stay consistent. Refine over time.

Reference: Investopedia.com