Impact of War on Economy and Gold: How Global Conflicts Reshape Financial Markets

Many analysts have studied the impact of war on the economy and gold throughout history

Introduction

The impact of war on economy and gold is profound and far-reaching—touching everything from inflation and currency valuation to investor sentiment and global trade. History shows that armed conflicts not only damage infrastructure and reduce productivity, but also trigger financial anxiety that ripples across global markets.

Among the first assets to react is gold, long considered a safe haven during political and economic uncertainty. Similarly, the Forex market responds immediately to war-related headlines, with sharp price movements and increased volatility.

At FastPip, we closely monitor geopolitical developments to generate real-time trading signals and adjust our copy trading strategies accordingly. If you’re looking for smarter ways to navigate high-risk periods without constant chart watching, check out our Forex Signals and Copy Trading services—designed to help you stay ahead during turbulent times.

In this article, we offer a complete analysis of how wars influence global economies, affect gold prices, and reshape Forex trading patterns. Whether you’re a trader or an investor, understanding the impact of war on economy and gold is key to making informed decisions in a volatile world.

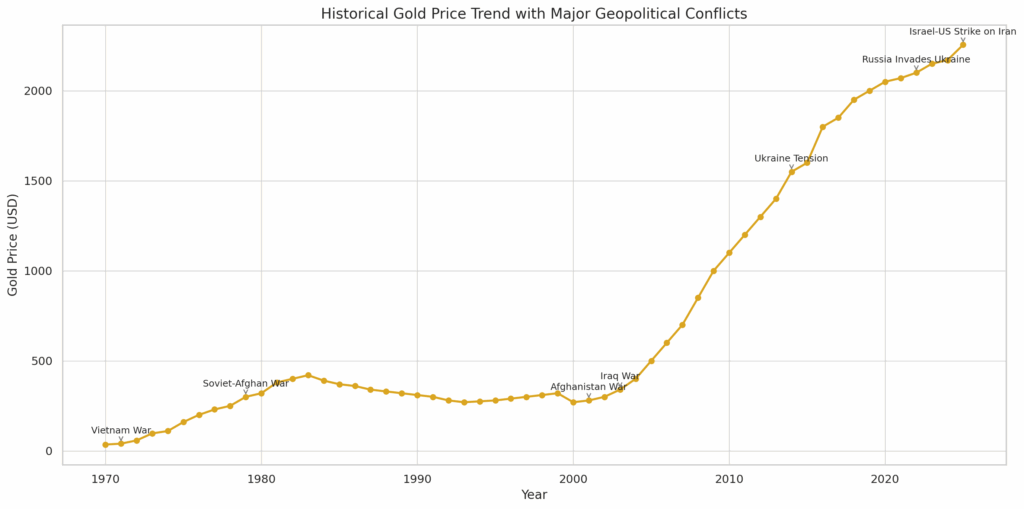

Section One: Historical Impact of War on Gold Prices and Economic Volatility

Over the past decades, the world has witnessed numerous military conflicts that have not only altered the fate of nations but have also directly impacted global financial markets. Among all assets, gold has consistently experienced significant growth during times of war. In periods of geopolitical crisis, investors seek safe-haven assets, and gold has always been at the top of that list.

Vietnam War (1955–1975):

This conflict, one of the longest military engagements of the 20th century, caused unprecedented political and economic uncertainty in the United States. In 1971, President Nixon officially ended the dollar’s convertibility to gold (marking the end of the gold standard). This move, coupled with the ongoing war, triggered a sharp rise in gold prices—from around $35 to over $800 per ounce by the early 1980s.

Soviet Invasion of Afghanistan (1979):

During the Cold War era, the Soviet Union’s invasion of Afghanistan sparked a fresh wave of insecurity across global markets. In 1980, gold prices hit a historical record of $850 per ounce—a level that remained unmatched until 2008.

U.S. Invasion of Iraq (2003):

The start of the Iraq War triggered intense market volatility. Gold, which had been trading below $400, quickly began an upward trend and surpassed $1000 per ounce by 2008.

Russia–Ukraine Conflict (2014, escalated in 2022):

Initial tensions in Crimea and the full-scale Russian invasion in 2022 became one of the major catalysts for gold price surges in recent years. Prices rose rapidly from around $1800 to over $2000 per ounce, driven by geopolitical uncertainty, economic sanctions, and rising demand for safe-haven assets.

Afghanistan War (2001):

Following the 9/11 attacks and the U.S. military intervention in Afghanistan, investors rushed into gold. In the years that followed, gold prices rose sharply, marking another wave of crisis-driven gains.

Israeli and U.S. Strikes on Iran (June 2025):

In June 2025, the Middle East once again became the centre of global geopolitical tensions. Massive airstrikes by Israel targeted several military bases and critical infrastructure in Iran, including the Natanz nuclear facility and missile sites in Kermanshah and Hamedan. Limited but direct U.S. military involvement swiftly followed the strikes.

Immediate Market Reactions:

-

Gold jumped by more than $80 within 24 hours, rising from $2170 to $2255 per ounce.

-

Oil markets reacted sharply; Brent crude prices surged from around $92 to over $107.

-

In the Forex market, the U.S. dollar strengthened as a haven, while currencies like the euro and Japanese yen experienced heightened volatility.

-

Global stock indices, particularly in Europe and Asia, saw short-term declines as investors fled to U.S. bonds and gold.

Reasons Behind the Rapid Market Response:

-

Fears of energy supply disruptions from the Persian Gulf

-

Concerns over the conflict spreading to neighboring countries

-

Reciprocal threats from Iran and Israel about continued hostilities

-

The presence of the United States in the region and the potential for escalation into a broader regional or global war

This incident serves as the latest example of how wars directly impact the global economy. Even though the conflict remained limited in scope, the market response confirmed that geopolitical tensions continue to be a dominant driver of gold surges and currency volatility.

From the Vietnam War to the recent Iran strike, gold has consistently played the role of a safe haven—a dependable asset that investors turn to when political unrest and global threats undermine security.

Understanding the impact of war on the economy and gold is crucial for investors.

Section Two: Why Is Gold a Safe-Haven Asset During War-Induced Market Volatility?

Analyzing the Role of Gold During Geopolitical Crises and Armed Conflicts

Gold has held a special place in the global financial system and in the minds of investors for centuries. But why does the demand for gold surge during times of war, geopolitical crises, or financial market collapses? The answer lies in a unique combination of gold’s inherent characteristics, the structure of the global market, and investor psychology.

-

Gold is a Store of Value Without Credit Risk

Unlike fiat currencies backed by governments or central banks, gold is a physical asset free from credit risk. Owning gold does not require trust in any specific institution or economy. That’s why, in times of weakened public trust—such as during war or sanctions—markets recognize gold as a reliable safe-haven asset.

-

Limited Supply and Non-Printable Nature

Unlike currencies or government bonds, central banks cannot print gold. During periods when governments print excessive money to finance wars—leading to inflation—gold tends to retain or even increase in value, preserving purchasing power.

-

A Proven Track Record in Crises

Gold has historically performed well during major crises such as World War II, the Vietnam War, the 2008 financial crash, the COVID-19 pandemic, the Russia–Ukraine war, and the 2025 conflict involving Iran and Israel. This historical reliability strengthens investor confidence and reinforces gold’s psychological appeal.

-

Gold Is Uncorrelated with Other Markets

While most risk assets—such as stocks or speculative currencies—tend to decline during crises, gold usually moves in a different direction. This makes gold a powerful diversification tool. Major institutional investors, including central banks and hedge funds, often allocate a portion of their portfolios to gold during turbulent times.

-

Global Acceptance and High Liquidity

Gold is universally accepted—from New York and London to Asian and Middle Eastern markets. Its high liquidity ensures that investors can quickly convert it into cash when needed, regardless of where they are.

-

Capital Never Sleeps: Gold as a Destination During Market Recessions

A fundamental principle of economics is that capital is always in motion; it doesn’t remain idle. When stock markets enter recession, interest rates fall, or economic forecasts turn negative, investors rapidly search for alternative destinations to preserve their wealth.

In such environments, gold emerges as one of the most attractive options because:

-

Unlike stocks, gold doesn’t depend on corporate earnings or economic growth.

-

During recessions or stock market crashes, demand for gold typically increases.

-

Allocating capital to gold helps protect wealth and reduce portfolio risk.

In short, when confidence in risky markets declines, gold becomes the ultimate “refuge market.” This capital flow dynamic drives gold prices higher during crises, even without an increase in industrial demand.

Section Three: Can Gold Predict War-Induced Economic Crises?

In the world of financial markets, there’s a popular saying:

“Prices move before the news.”

Gold, as one of the most sensitive assets to geopolitical developments, often acts as a forward-looking indicator of events that haven’t yet appeared in the media.

Why Does Gold React Early?

The gold market is largely driven by professional and global players—such as central banks, investment funds, governments, and large-scale investors—who often have access to first-hand information, confidential intelligence, or early security assessments.

Moreover, gold is highly responsive to sentiment. Even credible rumours or sudden shifts in trading volume can cause significant price movements, often before the general public is aware that a crisis is unfolding.

In essence, gold not only reflects the current state of the world, but also anticipates risk, making it a powerful and early signal of upcoming geopolitical and economic shocks.

Real Examples of Gold’s Early Market Reactions:

-

In February 2022, gold prices began rising nearly a week before Russia launched its invasion of Ukraine, despite the absence of any official announcement from Russian authorities.

-

In June 2025, just two days before Israel’s airstrikes on Iran, global gold markets experienced a sudden $30 surge. This unexpected spike reflected growing fear in international markets, even before the attack was officially confirmed.

Gold as a Barometer of Market Sentiment

Unexpected volatility in gold—especially in the absence of major economic data—can serve as a hidden warning sign of an impending military or political crisis.

Professional traders often refer to this phenomenon as “Smart Money Flow”—capital that senses danger before it becomes public knowledge.

Section Four: Gold’s Role in Wealth Protection During Wartime Market Volatility

Many people see the gold market solely as a place for trading and profit. However, one of gold’s most important functions in financial markets is preserving the real value of money and assets against declining purchasing power.

Gold: An Insurance Policy for Capital

During periods of high inflation, currency devaluation, stock market crashes, or even banking liquidity crises, gold steps in as a reliable safe haven.

Buying gold in such times is not merely about short-term gains—it’s about protecting the long-term real value of capital.

For example, imagine an investor living in a country where the national currency has lost value due to war, sanctions, or inflation. Even if gold sees only a modest price increase, it can still help this investor preserve purchasing power internationally, effectively safeguarding the value of their wealth.

Gold: A Debt-Free, Independent Asset

Unlike stocks or bonds, gold carries no obligations or credit risk. You own a tangible commodity that is not locked into any financial system and can be exchanged anywhere in the world.

This is why wealthy individuals, governments, and major investment funds allocate a portion of their portfolios to gold, not for speculation, but for security and long-term stability.

Strategic Uses of Gold in Long-Term Wealth Management:

-

Preserving asset value against inflation and currency depreciation

-

Diversifying investment portfolios

-

Enhancing portfolio resilience during financial crises

-

Protecting wealth from geopolitical risks

Section Five: Why Is Gold Traded During Wartime—but Not Diamonds?

At first glance, both gold and diamonds may appear to be rare and valuable assets. However, in times of war, crisis, or economic collapse, it is gold alone that plays a critical role in trade, wealth preservation, and global exchange.

Why? Because gold possesses a set of features that diamonds and other precious stones simply lack.

1.Gold’s Global Standardization and Real-Time Market Pricing

Gold is traded based on a universally accepted standard—defined by purity (such as 24k or 999.9 fine gold) and weight—and its price is updated in real time on global exchanges like COMEX or the London Bullion Market.

Diamonds, in contrast, have no single universal pricing standard. Each stone must be individually appraised based on cut, clarity, carat, and colour, making valuation subjective and far less transparent than gold.

2. Gold Offers High Liquidity, Unlike Diamonds, Which Are Hard to Sell

Gold is one of the most liquid assets in the world. You can easily sell it anywhere, anytime, often for a price close to the global market rate.

Diamonds, however, are much harder to sell, especially during crises. Each diamond must be individually evaluated, and finding a buyer willing to pay fair value can be difficult, particularly when market demand shrinks in wartime.

3. Market Transparency and Lower Risk of Fraud in Gold Transactions

The gold market is highly transparent. Buyers and sellers deal with clearly defined standards—purity, weight, and globally published prices. This reduces the likelihood of deception.

In contrast, the diamond market is less regulated and more opaque. Fraud, counterfeit certificates, and price manipulation are much more common. During wartime, when oversight weakens, these risks become even greater, making diamonds a far riskier choice for investors.

4. Gold Has a Long History as a Medium of Exchange—Diamonds Do Not

Gold has been used as a recognised medium of exchange for thousands of years—from ancient Roman coins to modern gold bars. It has served as currency, a store of value, and a means of payment across civilisations and economic systems.

Diamonds, on the other hand, have never played a formal role in global trade or monetary systems. They are seen as luxury items rather than standardised, exchangeable assets, especially during times of crisis.

5. The Gold Market Is Transparent, Legal, and Regulated

Gold is traded through regulated exchanges, licensed dealers, and monitored financial institutions. Its market operates under clear legal frameworks, which adds trust and credibility, especially during times of instability.

In contrast, the diamond trade is largely private, fragmented, and less regulated. It often lacks transparency and can be influenced by informal networks. During crises, investors prefer the legal protection and reliability that the gold market offers.

Section Six: Comparing Gold and Real Estate in the Face of War’s Economic Impact

In times of geopolitical tension and military conflict, investors seek assets that can both preserve their wealth and offer fast, secure access. Among the most common choices are gold and real estate. But how do these two asset classes compare when war disrupts economies and financial systems?

In this section, we’ll examine the key differences in liquidity, portability, risk, and resilience between gold and property during wartime.

Liquidity and Immediate Accessibility

Gold is one of the most liquid assets in the world. It can be sold quickly and easily in almost any country or market, often within minutes and close to the global spot price.

In contrast, real estate lacks immediate liquidity—selling a property can take weeks or even months, especially during wartime when housing markets may freeze or collapse. This makes gold a far more practical choice for investors needing quick access to cash in times of crisis.

Portability and Geographic Flexibility

Gold is a portable asset. It can be stored, transported, or exchanged almost anywhere in the world with relative ease. In times of war or political instability—when people may be forced to flee or move capital abroad—gold offers unmatched flexibility.

Real estate, on the other hand, is a fixed asset tied to a specific location. It cannot be moved or relocated, making it vulnerable to regional threats and far less adaptable in times of conflict or migration.

Physical Risk and Vulnerability

Real estate faces major threats during war. These include bombings, military occupation, and possible government seizure under emergency conditions.

Gold, by contrast, can be stored securely in vaults, transported out of conflict zones, or kept in international banks. This makes it far more resilient against the physical and legal risks that often endanger real estate during wartime.

Physical Risk and Vulnerability

During war, real estate faces serious physical risks. These include destruction by airstrikes, military occupation, or even government seizure under emergency laws.

Gold, by contrast, can be stored securely in vaults, transported out of conflict zones, or kept in international banks. This makes it far more resilient against the physical and legal risks that often endanger real estate during wartime.

Gold Ownership and Legal Restrictions During Conflict

In times of war, governments may impose emergency regulations on real estate, such as freezing property transactions, seizing assets, or restricting foreign ownership.

Gold, however, offers greater personal control and privacy. As a portable and universally accepted asset, it is less subject to government intervention. Ownership is straightforward, and there are fewer legal barriers to storing or transferring gold across borders, making it a more reliable tool for wealth protection in uncertain times

Overall Analysis: Markets, Gold, and Capital in the Shadow of War

War brings sudden and profound disruptions to the global financial system. In such times, markets no longer move solely based on economic indicators—they become deeply influenced by fear, political instability, and fast-changing geopolitical developments.

Amid this uncertainty, gold emerges as a multi-functional asset. Gold’s rising demand during wartime comes not just from profit-seeking. Instead, people value its ability to preserve wealth, offer liquidity, provide security, and maintain global trust over time.

In contrast, assets like real estate—which may be lucrative in stable times—face serious challenges during conflict: illiquidity, destruction risk, lack of portability, and legal complications.

As discussed throughout this article, gold can even signal major crises before they officially unfold, reacting to market sentiment faster than traditional news channels. This shows that gold is not just an asset—it is a silent language of global financial emotion.

Ultimately, gold is more than an investment; it is a tool for wealth management, risk distribution, and protecting the real value of capital against inflation, currency collapse, and systemic breakdowns.

Final Summary: Why Gold Plays a Vital Role During War

Wars threaten not only the physical security of nations but also the stability of global economies and financial systems. In such conditions, investors urgently seek ways to shield their capital from crisis.

Gold, thanks to its unique characteristics, becomes their first line of defence:

- It is portable

- It is highly liquid

- It is globally recognised

- And most importantly, it has been trusted throughout history.

During conflict, many assets—such as real estate or currencies—can lose value or be out of reach. But gold remains strong. Not as the only option, but as the safest refuge for capital in the storm of war and political turmoil.

Sources and Further Reading:

The authors used data, research, and insights from top global sources. These include the IMF, the World Gold Council, Bloomberg, and Reuters.

- World Gold Council – Gold and Geopolitical Risk

- IMF – Economic Impact of Conflict

- Bloomberg – Gold Price Reactions to War

- Investopedia – Safe Haven Assets

- Reuters – Market Reactions to Geopolitical Tensions