📰 July FOMC Meeting Recap: Divided Opinions and Cautious Policy Stance

Introduction

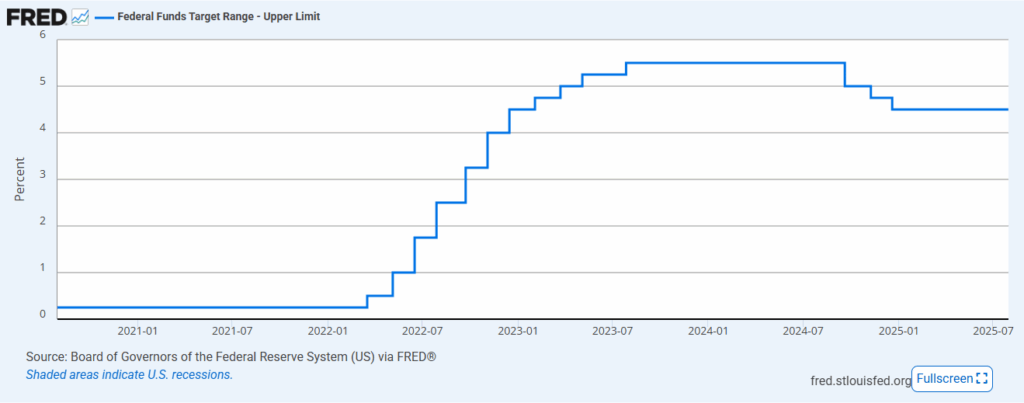

The Federal Reserve left interest rates unchanged at its July meeting, marking the fifth consecutive decision to hold steady. While the official statement saw minimal changes, underlying tensions within the committee became more evident, especially with the rare dual dissent from Governors Waller and Bowman, who advocated for a 25-basis-point rate cut.

Policy Status Quo Maintained—For Now

The federal funds rate remained in the 4.25%–4.50% range (see Chart 1), as the Fed emphasized “somewhat elevated” inflation and “solid” labor market conditions. Chair Jerome Powell acknowledged economic resilience, noting that current financial conditions allow time for the committee to assess incoming data before adjusting its policy stance. However, he also flagged softening momentum in growth and potential downside risks in employment.

Split Views Among Fed Officials

For the first time since 1993, two Fed governors formally dissented in favor of an immediate rate cut. While their dissent may partly reflect political dynamics—especially as Powell’s term nears its end—it also signals genuine division within the committee regarding how to respond to mixed signals: persistent inflation, tight labor markets, and trade-induced stagflation risks.

Inflation and Employment in Focus

Core PCE inflation, the Fed’s preferred measure, remains above the 2% target, with a 2.7% YoY reading and 1.7% three-month annualized pace as of May (Chart 2). Unemployment, meanwhile, stood at 4.1% in June—within the Fed’s longer-run central range (Chart 4). Despite this stability, Powell emphasized caution, stating that a weak labor market could prompt a policy shift.

The Dot Plot: Easing Path Ahead?

The Fed’s updated dot plot (Chart 3) still projects multiple rate cuts ahead, with the median forecast for year-end 2025 slightly above 3%. However, the timeline remains data-dependent. Committee members expect more clarity after two upcoming inflation prints and two employment reports before the next meeting in mid-September.

September Cut? Markets Say “Maybe”

As of now, markets are pricing a roughly 49% chance of a 25 bps cut in September. FastPip’s current outlook anticipates three rate cuts by year-end—starting in September and continuing in October and December—subject to confirmation from upcoming macroeconomic data.

📊 Core PCE Inflation – May 2025 Snapshot

The Core PCE Price Index, which excludes the more volatile categories of food and energy, helps highlight the underlying trend in inflation. This index is published monthly as part of the Personal Income and Outlays report and is considered one of the Federal Reserve’s preferred gauges for assessing price stability.

Here’s the year-over-year change in core PCE inflation over recent months:

- May 2025: +2.7%

- April 2025: +2.6%

- March 2025: +2.7%

- February 2025: +2.9%

By removing food and energy prices—which often fluctuate significantly—the core PCE index provides a clearer view of long-term inflation dynamics. Its consistent readings above the Fed’s 2% inflation target are closely monitored as policymakers weigh their next interest rate moves.

📈 FOMC Economic Projections – July 2025 Overview

At the July 2025 meeting, the Federal Reserve released its updated economic projections covering GDP growth, unemployment, inflation, and interest rates through 2027 and beyond. These forecasts offer a forward-looking perspective on how policymakers expect the economy to evolve under current conditions.

Key highlights include:

-

Real GDP growth is expected to gradually accelerate from 1.4% in 2025 to 1.8% in 2027.

-

Unemployment rate projections remain stable around 4.4%–4.5% in the near term, gradually declining over the longer run.

-

PCE and core inflation are forecast to ease closer to the Fed’s 2% target by 2027.

-

The federal funds rate is projected to decline gradually from 3.9% in 2025 to 3.0% in the longer term, reflecting a shift toward policy normalization.

These projections play a key role in shaping market expectations and monetary policy decisions. For traders and analysts, tracking the Fed’s median forecasts and range estimates is essential for understanding future interest rate moves and economic risks.

📊 FOMC Economic Projections Table – July 2025

| Variable | 2025 (Median) | 2026 (Median) | 2027 (Median) | Longer Run (Median) | 2025 (Range) | 2026 (Range) | 2027 (Range) | Longer Run (Range) |

|---|---|---|---|---|---|---|---|---|

| Change in real GDP | 1.4% | 1.6% | 1.8% | 1.8% | 1.1–2.1% | 0.6–2.5% | 0.6–2.5% | 1.5–2.5% |

| Unemployment rate | 4.5% | 4.5% | 4.4% | 4.2% | 4.3–4.6% | 4.3–4.7% | 4.0–4.7% | 3.5–4.5% |

| PCE inflation | 3.0% | 2.4% | 2.1% | 2.0% | 2.5–3.3% | 2.1–3.1% | 2.0–2.8% | 2.0% |

| Core PCE inflation | 3.1% | 2.4% | 2.1% | – | 2.5–3.5% | 2.1–3.2% | 2.0–2.9% | – |

| Federal funds rate | 3.9% | 3.6% | 3.4% | 3.0% | 3.6–4.4% | 2.6–4.1% | 2.6–3.9% | 2.5–3.9% |

Conclusion

While the July meeting delivered no surprises in action, the tone of the discussion revealed deeper divisions within the Fed. With Powell staying deliberately neutral and data volatility ahead, the central bank’s next move will be highly dependent on labor market softness and inflation moderation in the coming months.

Stay tuned to the FastPip Blog for ongoing updates, expert analysis, and trading strategies based on real-time macroeconomic developments.

Check Our

Check Our  Whether you’re a day trader or a long-term investor, FastPip gives you the tools to trade smarter, not harder.

Whether you’re a day trader or a long-term investor, FastPip gives you the tools to trade smarter, not harder.