Trading Psychology: The Key to Sustainable Success in Financial Markets

Introduction

In the high-pressure world of financial markets, many traders believe that success depends solely on technical or fundamental analysis. In reality, however, there is a third pillar—perhaps the most crucial one—for long-term profitability: trading psychology.

The human brain responds instinctively to risk, reward, and loss—often in irrational ways. These psychological reactions can significantly affect a trader’s decisions, especially under pressure.

That’s why platforms like FastPip Copy Trading and our free signal section are designed not only to provide you with winning strategies but also to reduce emotional stress by automating decision-making or following expert traders. By taking emotions out of the equation, these tools help traders stay disciplined, stick to proven systems, and avoid costly psychological mistakes.

In this article, we will take a deep and practical journey into the trader’s mind—from emotional triggers and hormonal reactions to mental exercises and the mindset of successful traders. Mastering trading psychology plays a crucial role in helping traders manage emotional impulses and remain consistent over time.

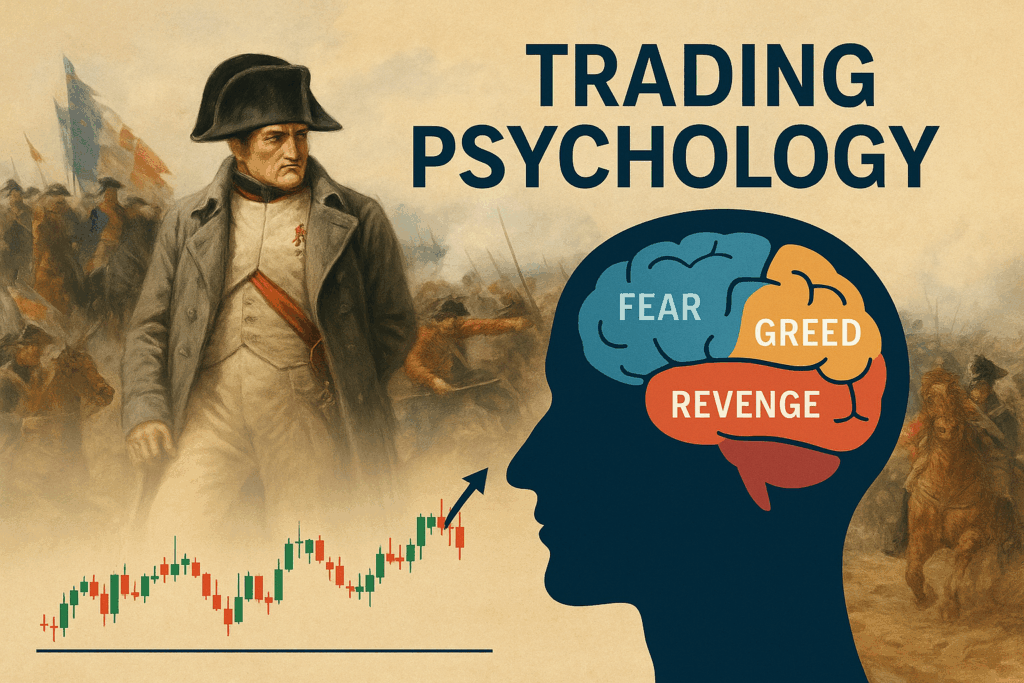

Part 1: Emotions and Trading Psychology – What Napoleon Can Teach Traders

In the world of trading psychology, history offers powerful lessons. One of the most famous is Napoleon’s defeat at the Battle of Waterloo in 1815. After returning from exile, Napoleon was driven by ego, fear, and revenge. He ignored crucial intelligence, rushed into war without solid planning, and made emotional decisions. The outcome was a legendary failure.

Just like Napoleon, many traders let emotions like fear, greed, and revenge take over. These are the emotional traps that destroy trading performance. Mastering your emotions is essential if you want to develop strong trading psychology and become consistently profitable.

Common Emotional Triggers in Trading:

Fear

- Fast heartbeat, panic, mental fog

- Exiting trades too early

- Avoiding great setups

- Freezing during volatility

Greed

- Oversized positions without proper analysis

- Ignoring stop losses

- Overtrading from excitement

Revenge Trading

- Trying to recover losses emotionally

- Entering impulsive trades after losing

- Making bigger mistakes instead of learning

If you don’t control these emotions, they will control your trading decisions. That’s why emotional discipline is a cornerstone of strong trading psychology.

🧠 Part 2: How Brain Chemistry Influences Trading Psychology

In the world of trading psychology, success isn’t just about charts or strategies—it’s also about what’s happening inside your brain. Chemical messengers like dopamine, serotonin, cortisol, and adrenaline significantly impact how you respond to wins, losses, and pressure.

Learn more about how dopamine and cortisol affect decision-making from this:

Research article by the NCBI.

Let’s break down these key brain chemicals and how they shape your trading behavior:

🥇 Dopamine – The Reward Hormone

Dopamine is released after a winning trade. It creates pleasure and confidence, reinforcing success. But too much dopamine can lead to overconfidence and even a trading addiction, where you’re chasing the high rather than following your plan.

📉 Negative Effects:

• Overtrading

• Ignoring stop-loss rules

• Taking impulsive risks

😌 Serotonin – The Mood Regulator

Serotonin keeps you emotionally balanced. After long losing streaks or intense stress, serotonin levels drop—leading to fear, hesitation, or emotional fatigue. This can stop you from entering quality trades or sticking to your system.

📉 Negative Effects:

• Anxiety before trades

• Hesitation or fear of pulling the trigger

• Lack of trading motivation

⚠️ Cortisol – The Stress Hormone

Cortisol rises during fear, uncertainty, and drawdowns. While short bursts of stress can improve focus, chronic exposure harms decision-making and reduces clarity—leading to emotional or reactive trades.

📉 Negative Effects:

• Panic selling

• Inability to follow trading plans

• Mental burnout

⚡ Adrenaline – The Fight or Flight Hormone

Adrenaline kicks in during high volatility—like news events or breakouts. It gives a rush of energy but can override logic. Many traders act on impulse instead of sticking to a strategy.

📉 Negative Effects:

• Emotional entries during news spikes

• Sudden changes in strategy mid-trade

• Decision fatigue

💡 Pro Tip: To master trading psychology, you need to manage these hormones. Journaling your trades, meditating, maintaining a routine, and even using tools like copy trading can help you stay disciplined and in control.

🧘 Part 3: Mental Exercises to Strengthen Your Trading Psychology

Even the best strategy won’t work without the right mindset. Mental discipline and emotional control are what separate great traders from inconsistent ones. Here are proven mental exercises to help improve your trading psychology:

✍️ 1. Trade Journaling

Keeping a detailed trading journal allows you to track emotions, setups, and results—helping identify behavioral patterns over time.

🧠 Benefits:

• Spot emotional triggers

• Review past mistakes

• Reinforce discipline

📚 Learn more in our full article: Trading Journal Writing – Step-by-Step Guide

🧘♂️ 2. Mindfulness Meditation

Practicing mindfulness helps calm your mind before and after trades, improving clarity and reducing stress.

💡 Why it works:

• Reduces anxiety and impulsivity

• Improves emotional awareness

• Enhances focus in volatile conditions

🕒 How to Practice:

• Sit quietly for 5–10 minutes

• Close your eyes and focus on breathing

• When thoughts arise, observe and return to the breath

• Practice daily for lasting benefits

🎯 3. Simulated Practice (Backtesting & Demo Trading)

Before risking real money, practice your system to build both technical and mental confidence.

🔁 A) Backtesting

- Use 6–12 months of data

• Set fixed strategy rules

• Track win rate, drawdown, and average P/L

• Avoid over-optimizing

🧪 B) Demo Trading

- Create a demo that reflects real capital

• Trade with actual rules and size

• Monitor weekly performance

• Go live after 20–50 successful trades

💼 C) Pro Tips

- Include realistic spreads/slippage

• Stay emotionally honest

• Test during trending and ranging markets

🌬️ 4. Conscious Breathing

A quick and powerful technique to reset your emotional state before or after stressful trades.

🧘 Try This Breathing Pattern:

• Inhale: 4 seconds

• Hold: 4 seconds

• Exhale: 6–8 seconds

• Repeat: 1–3 minutes

✅ Use this anytime you feel fear, frustration, or revenge building up.

💼 Part 4: Trading Psychology Traits of Successful Traders

What separates top traders from the rest isn’t just their strategy—it’s their mindset. The world’s most successful traders have one thing in common: mental strength.

Here are the key psychological traits they develop and protect like assets:

✔️ 1. Acceptance of Losses

They don’t panic or blame themselves after a losing trade. Losses are viewed as part of the game, not personal failure.

💡 “A loss is not a mistake—it’s the cost of doing business in trading.”

🎲 2. Probability-Based Thinking

Instead of chasing certainties, top traders accept that each trade is just one outcome in a larger statistical edge.

They say:

“I don’t need to be right every time. I need to be profitable over time.”

🧘 3. Emotional Stability in All Outcomes

Win or lose, the best traders remain centered. They don’t get overconfident after wins or devastated after losses.

Their decisions are calm, measured, and intentional.

🧭 4. Discipline Over Everything

They follow their plan even when emotions beg them not to.

>No chasing. No revenge trades. No random bets.

Discipline turns a strategy from theory into consistent results.

🔍 Final Insight:

🧠 Most successful traders mastered their mind before they ever mastered the market.

Mindset isn’t a soft skill—it’s the core trading edge.

📈 Part 5: Turn Trading Psychology into Monthly Profit Strategies

Understanding trading psychology isn’t just about emotional control—it’s the foundation for profitable, repeatable strategies. Once you master your mindset, you can shift focus to building systems that generate monthly returns with consistency.

Here’s how psychology ties directly to real-world profit:

🔁 1. Discipline Enables Consistency

Following your strategy without emotional deviation builds long-term results—especially when trading with defined setups and risk rules.

⏳ 2. Patience Identifies Better Opportunities

Traders with psychological control wait for the right trades. They don’t force entries out of boredom or fear of missing out.

📊 3. Emotional Clarity Improves Strategy Execution

Staying calm allows you to manage trades properly, stick to take-profit and stop-loss levels, and avoid revenge trading.

💡 Want to see how top traders combine psychology and structure to achieve steady monthly returns?

👉 Read our full guide: Monthly Profit Strategies That Work

This article explains how copy trading, signal systems, and structured risk management can help you turn mindset into money—especially with FastPip’s expert tools.

✅ Final Thoughts: Master the Mind, Master the Market

Trading success isn’t just about having the best tools or strategies—it’s about mastering how your mind reacts to risk, pressure, and opportunity. The deeper your understanding of your emotional patterns, the more consistent and confident your trading decisions will become.

🧠 “Winning in the market starts with winning the battle within.”

Too many traders overlook the power of trading psychology, but it’s the missing link between potential and real profit. Make mindset your foundation—not an afterthought.

Ready to Level Up Your Trading?

📌 Want to build a strategy rooted in discipline and emotional control?

👉 Start with our Risk Management in Forex guide.

📈 Looking for consistent monthly profits without the stress?

👉 Explore proven Forex Monthly Profit Strategies.

🔁 Prefer to follow top-performing traders during peak hours?

👉 Join our Forex Copy Trading Program powered by real strategies and real results.